Housing Market Update – July Week 4: Home Prices Rise, Fed Rates Impact, and New Home Sales Surge

Welcome to your weekly housing market update for the last week of July. I’m Larry Gonzales, and we have a lot to cover, including home prices, inventory, interest rates, and the recent actions of the Federal Reserve.

Verify your mortgage eligibility (Mar 3rd, 2026)Let’s dive into the details and get this party started!

Housing Market Prices

Housing prices continue to rise, reflecting strong demand in the market. Unfortunately, inventory remains relatively flat, which is contributing to the ongoing supply-demand imbalance. Many wish for more available homes to meet the high demand.

Interest Rates

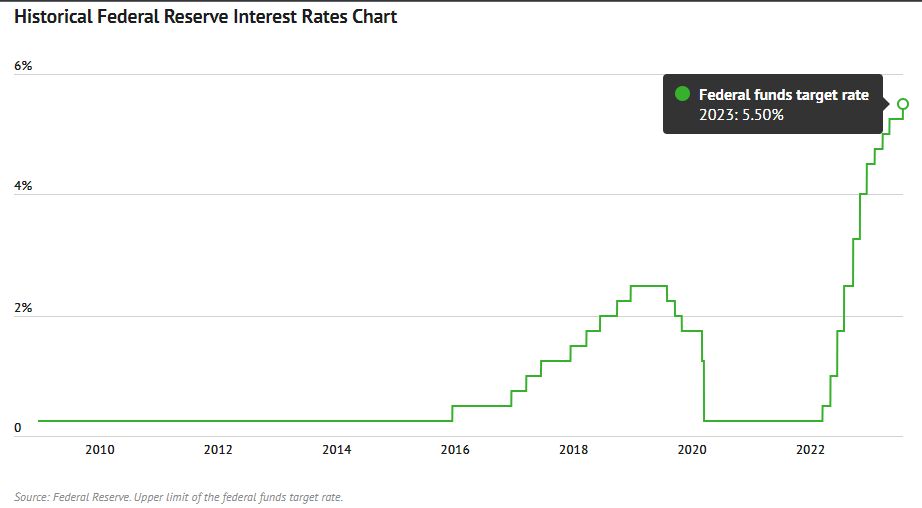

Interest rates have been fluctuating, and recently, they have mostly gone up. However, the situation is dynamic, and it’s important to keep an eye on further developments. The Federal Reserve’s actions have been impacting the rates significantly.

Verify your mortgage eligibility (Mar 3rd, 2026)Federal Reserve’s Influence

The Federal Reserve made headlines this week by raising the fed funds rate to 5.5%, the highest level in 22 years. They have been working to manage inflation and employment levels. Despite record-low unemployment rates, achieving their target of over 4% unemployment has been challenging due to the high number of available jobs. The Fed’s recent change in tone suggests some reassurance in their approach to managing the economy.

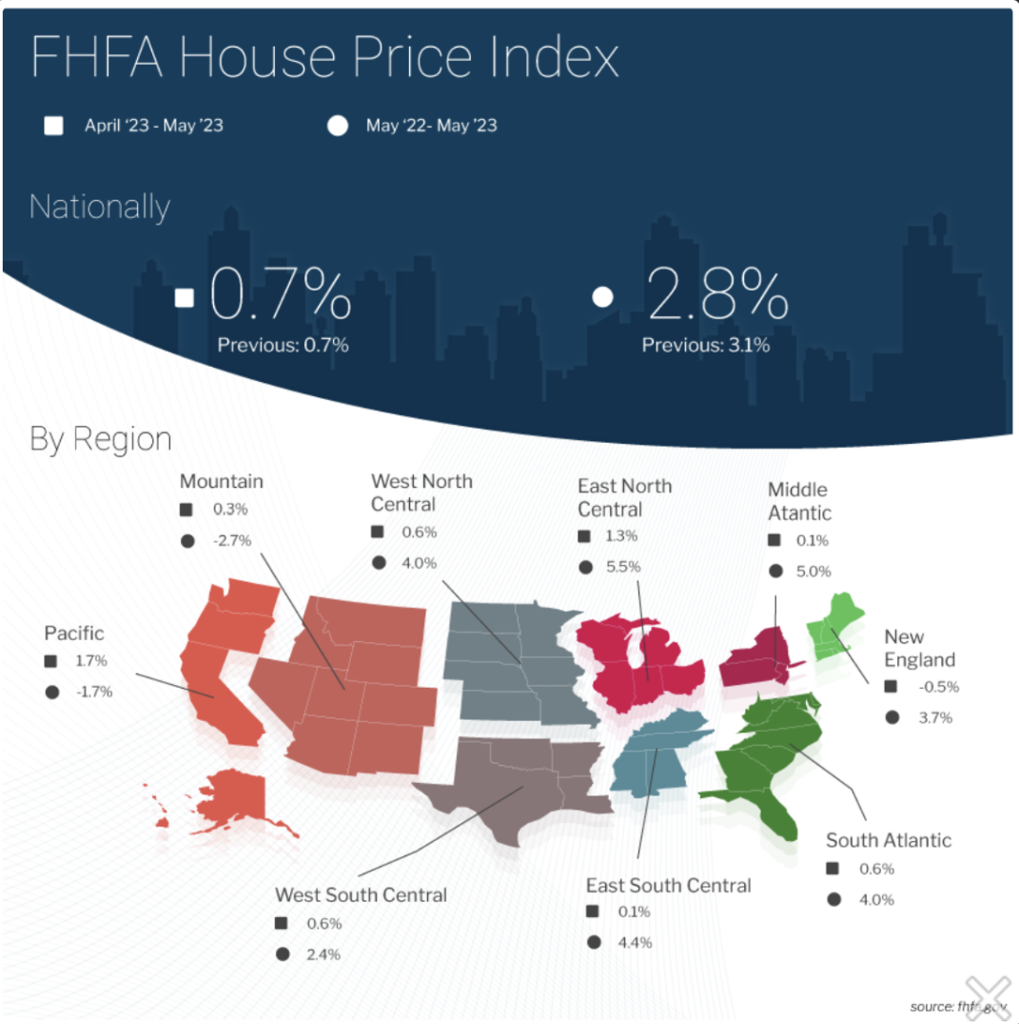

Home Price Appreciation

Home price appreciation has been solid across the nation. Compared to the peak levels during the pandemic, we are currently only down by half a percent. Top cities such as New York, Cleveland, and Detroit have seen significant month-over-month appreciation due to the rebound from the pandemic’s impact.

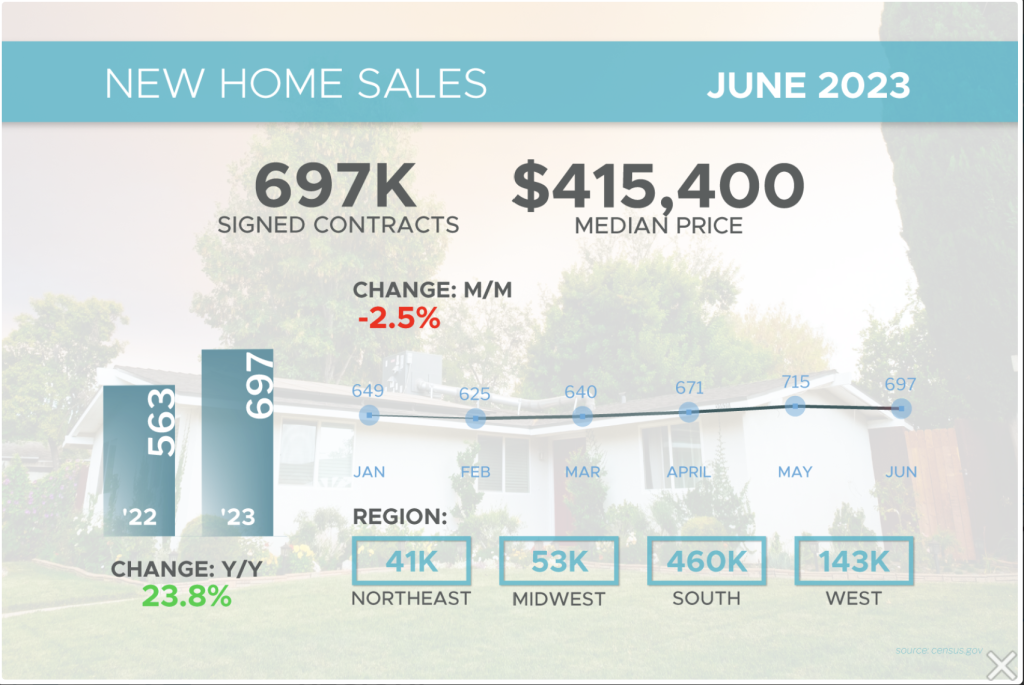

New Home Sales

New home sales saw a drop, with May figures revised even lower. However, year-over-year, there has been an increase of almost 24%. This surge is partly due to buyers signing contracts for new homes, and it doesn’t necessarily mean construction has started. Some homebuilders are offering incentives to sell their existing homes to cope with the backlog of new homes on the market.

Verify your mortgage eligibility (Mar 3rd, 2026)Interest Rates – Continued Volatility

Interest rates have experienced significant fluctuations, and this trend is likely to continue. Economic reports, such as the personal consumption expenditure report, can influence rates. The market remains unpredictable, but overall, we expect rates to decrease if inflation comes down as expected.

Tips for Home Buyers and Sellers

Verify your mortgage eligibility (Mar 3rd, 2026)For buyers, it’s essential to consider the current market conditions. With home prices appreciating at a healthy rate, waiting may lead to higher costs in the future. Low inventory levels make it a seller’s market, but sellers should avoid being overly greedy and work with loan officers to explore their options before making decisions.

In conclusion, the housing market remains dynamic and affected by various factors, including interest rates, inventory, and the actions of the Federal Reserve. Home prices continue to appreciate at a healthy pace, making it a good time for buyers to secure a home. However, the market is subject to change, and consulting with professionals can help both buyers and sellers navigate the current conditions effectively. Remember, control what you can and make informed decisions for your financial future.

Folks, brace yourselves; this is big news. Existing home sales are currently at historic lows. When we compare the current inventory to the housing bubble of 2008, it’s jaw-dropping. Back then, we had a whopping 4 million homes on the market. Today, we’re down to just 1.4 million! With homeowners holding onto their properties, there’s simply not enough supply to meet the soaring demand.

Verify your mortgage eligibility (Mar 3rd, 2026)Now, let’s talk rates. They’ve had a wild ride through June and July, but they’re currently hovering around 6.5%. Steady as she goes, I say. We expect them to stay in the 6% to 7% range until we see a significant inflation report. So, homebuyers, it might be time to make your move while the rates are still relatively low!

Aloha!